TradingView

Founded Year

2011Stage

Series C | AliveTotal Raised

$339.37MValuation

$0000Last Raised

$298M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About TradingView

TradingView is a financial charting platform and social network for traders and investors. The company provides tools for real-time market data analysis, enabling users to share and discuss trading strategies within an investment community. TradingView offers a suite of market analysis tools, including access to an economic calendar, collaborative trading ideas, and a custom scripting language for advanced charting. It was founded in 2011 and is based in Westerville, Ohio.

Loading...

TradingView's Product Videos

ESPs containing TradingView

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

TradingView named as Leader among 14 other companies, including Coin Metrics, Nansen, and Kaiko.

TradingView's Products & Differentiators

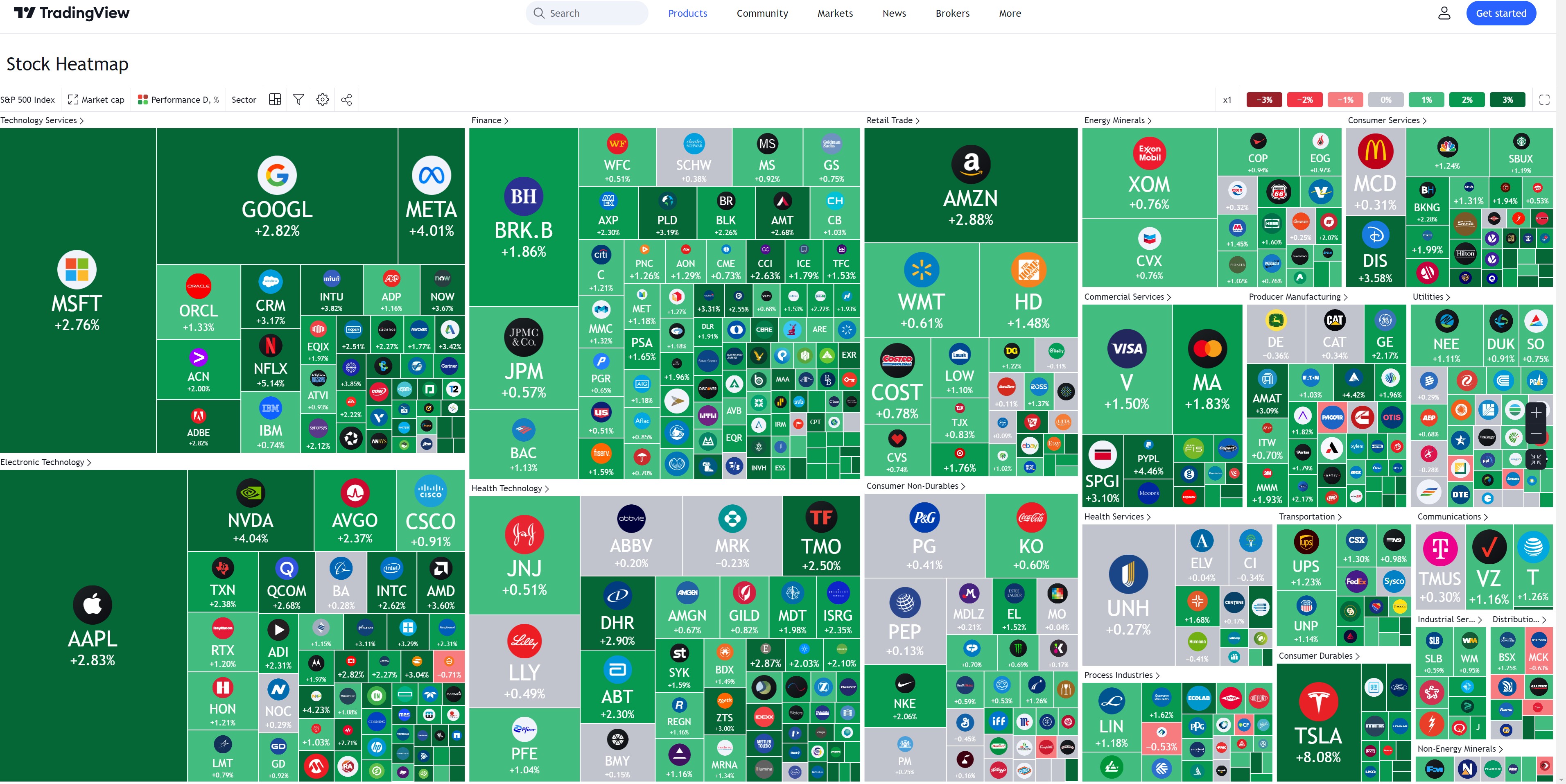

Charts

Best in class charts enabling comprehensive technical analysis of the markets

Loading...

Research containing TradingView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TradingView in 1 CB Insights research brief, most recently on Nov 11, 2022.

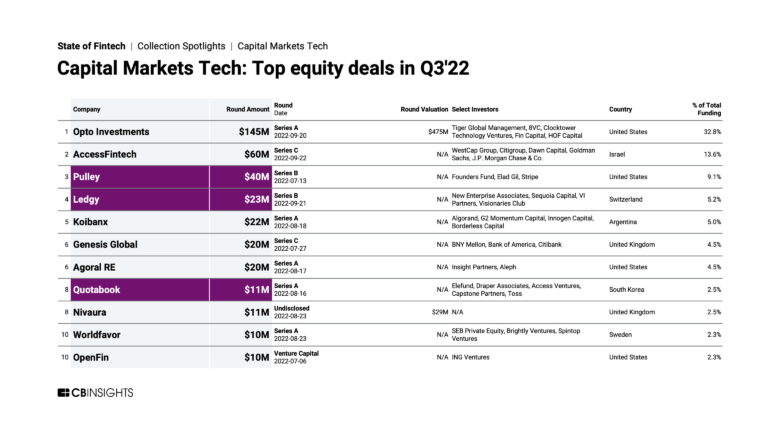

Nov 11, 2022

3 capital markets trends to watchExpert Collections containing TradingView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TradingView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,367 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,040 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest TradingView News

Mar 29, 2025

Analyst TehThomas sees ‘Golden Pocket' Fib support, potential bounce to $2.80+ XRP is the focus of discussion, particularly following the SEC officially dropping its lawsuit against fintech firm Ripple regarding past XRP sales. However, this major regulatory development hasn't yet produced the significant price surge many anticipated for XRP itself. The token currently trades around $2.13, marking a 6% drop in 24 hours, according to CoinMarketCap. After reaching a weekly high near $2.50, XRP faced a sharp correction, losing support at the 20-day Exponential Moving Average (EMA) around $2.17. This price action sparks debate on whether XRP is headed for a deeper fall or positioning for a major rebound. Bitwise 2025 Scenarios: Tokenization Boom vs. Institutional Lag? Investment firm Bitwise recently released a report exploring potential price paths for XRP through the end of 2025. Their analysis suggests outcomes depend heavily on XRP's adoption momentum, particularly for payments and within the broader digital asset tokenization market (projected by some to reach nearly $11 trillion by 2030). In Bitwise's bullish scenario, XRP could reach $4.48 by year-end 2025, assuming it captures even a small percentage of this expanding market. A steadier growth outlook in their analysis projects $3.90 for XRP, assuming consistent growth in related payment services (like those offered by Ripple). Conversely, Bitwise stated a bearish scenario occurs if XRP fails to gain significant institutional backing, potentially seeing the price drop to $1.82 in that case. Related: XRP's $2.22 Support Test: Make-or-Break Level for a Bullish $15 Scenario Chart Analyst Sees Bullish Pattern: XRP in ‘Golden Pocket'? Offering a contrasting, potentially more near-term bullish technical view, TradingView analyst “TehThomas” presented a different setup for XRP. He notes the asset currently trades within what appears to be an ascending channel pattern , often characterized by higher highs and higher lows indicative of an underlying uptrend. TehThomas highlights XRP's price now sitting within the 0.618–0.65 Fibonacci retracement zone of a prior upward move. This area, technically known as the “Golden Pocket,” is historically considered a strong potential reversal or support zone by chart analysts. He also notes the price aligns with an “imbalance zone,” suggesting price might naturally revisit these levels before potentially resuming an upward trend. Bounce to $2.80 Possible? Indicators Show Neutrality If XRP successfully holds the current levels within this Golden Pocket zone as key support, TehThomas predicted it could rally approximately 20% toward the $2.80–$2.90 resistance range. Current daily indicators provide additional context. The Relative Strength Index (RSI) reads near 52, suggesting a relative balance between buyers and sellers, although its recent downward gradient hints at increasing sell-side pressure. Related: Misinformation vs Reality: Clarifying XRP's Actual Role in Global Payments XRP's price also trades near the Bollinger Bands' mid-line, often signaling a potential consolidation phase. Key levels defined by the bands suggest a break below support near $2.10 could risk a test of the lower band (around $1.44), while a convincing move above resistance near $2.36 is needed to trigger a stronger rally attempt. Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company. Source: https://coinedition.com/xrp-price-march-30-holding-critical-2-10-support-key-for-bounce/

TradingView Frequently Asked Questions (FAQ)

When was TradingView founded?

TradingView was founded in 2011.

Where is TradingView's headquarters?

TradingView's headquarters is located at 470 Olde Worthington Rd, Westerville.

What is TradingView's latest funding round?

TradingView's latest funding round is Series C.

How much did TradingView raise?

TradingView raised a total of $339.37M.

Who are the investors of TradingView?

Investors of TradingView include Tiger Global Management, Insight Partners, Jump Capital, DRW Venture Capital, OkCupid and 8 more.

Who are TradingView's competitors?

Competitors of TradingView include TakeProfit, TipRanks, MacroMicro, Atom Finance, StockViva and 7 more.

What products does TradingView offer?

TradingView's products include Charts and 4 more.

Loading...

Compare TradingView to Competitors

Seeking Alpha is a financial services company that provides stock market analysis and investment tools. The company has a platform for investors to access investment research, including stock ideas, market news, and analysis of various financial instruments such as stocks, ETFs, and mutual funds. Seeking Alpha serves individual investors by offering tools and resources for making investment decisions. It was founded in 2004 and is based in New York, New York.

MetaTrader 5 is a trading platform for Forex, stocks, and futures markets within the financial services industry. The platform includes tools for technical and fundamental analysis, trading alerts, and automated trading, designed for individual traders and financial institutions. MetaTrader 5 provides services such as virtual hosting, mobile and web trading applications, and access to a marketplace for trading robots and indicators. It is based in Limassol, Cyprus.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

MarketSeer provides fundamental market research solutions for investments using its integrated platform. It provides benefits such as real-time market data and analysis, breaking news and expert commentary, in-depth research reports, investment ideas, interactive tools, and financial calculators. The company was founded in 2019 and is based in Johannesburg, South Africa.

Simply Wall St focuses on financial data simplification and investment research tools within the financial services sector. The company offers a platform that provides visual financial reports, fundamental analysis, portfolio tracking, and stock screening tools. It was founded in 2014 and is based in Sydney, Australia.

Stock Target Advisor specializes in financial market analysis and operates within the financial technology industry. The company offers tools including an automated stock screener, aggregator of analyst ratings, and market news. Stock Target Advisor serves individual and professional investors seeking to improve their strategies using data. It was founded in 2018 and is based in Waterloo, Ontario.

Loading...