Slope

Founded Year

2021Stage

Series C | AliveTotal Raised

$127.13MLast Raised

$15M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+87 points in the past 30 days

About Slope

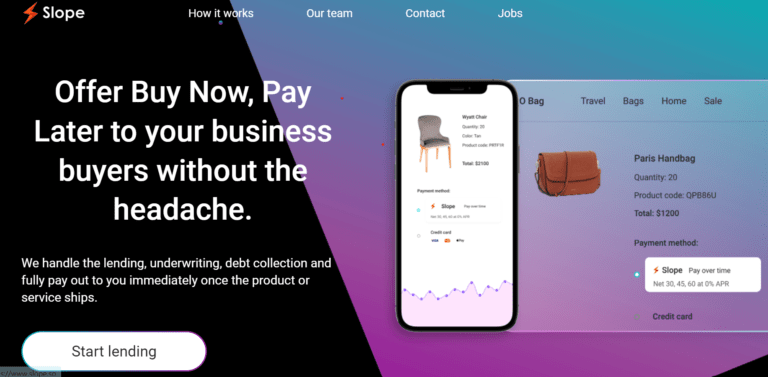

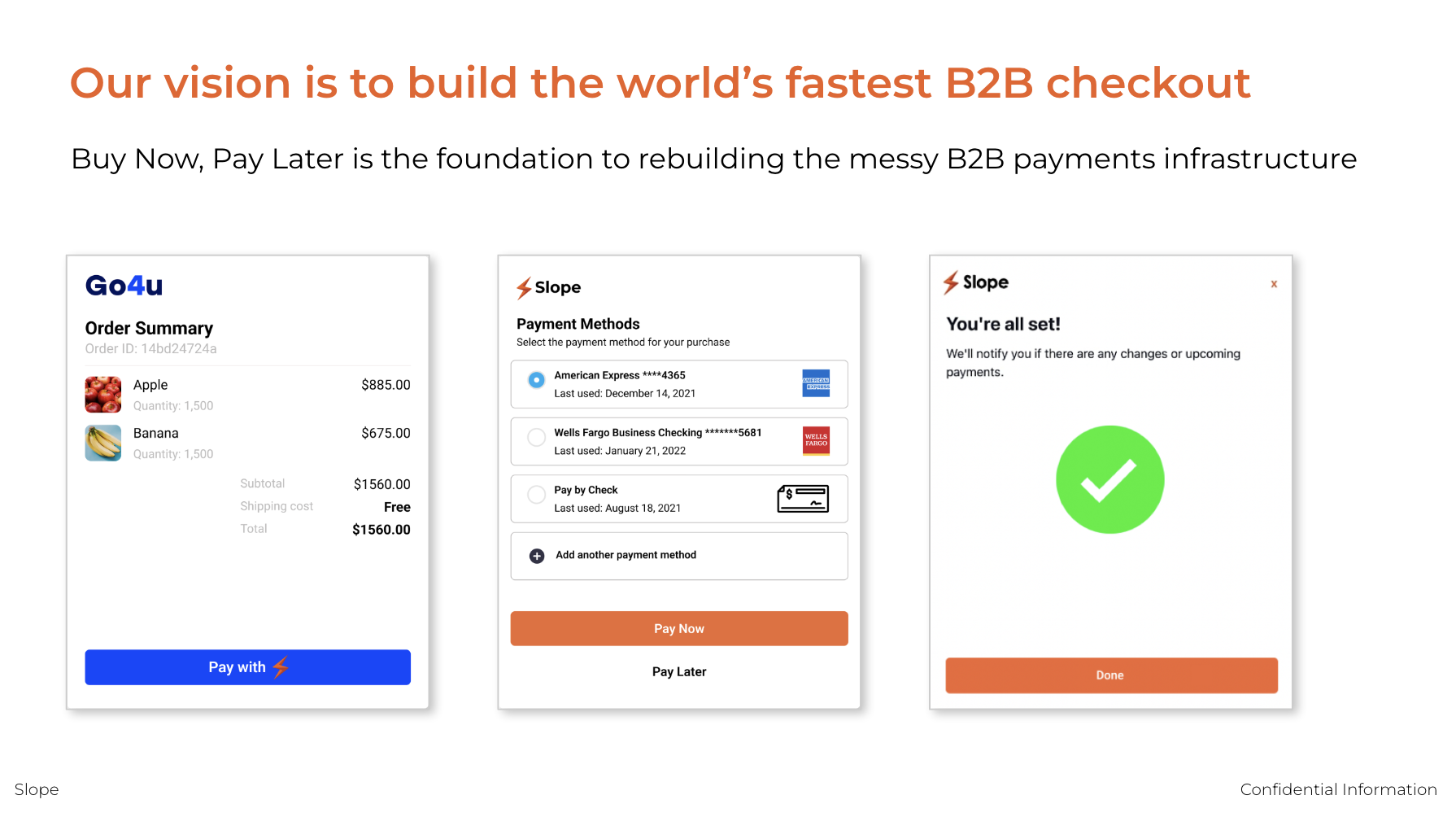

Slope specializes in B2B workflow automation within the financial technology sector. The company offers solutions for online payment processing, and flexible payment terms, and automates the entire order-to-cash cycle using its software and APIs. Slope primarily caters to businesses looking to streamline their financial operations and payment systems. It was founded in 2021 and is based in San Francisco, California.

Loading...

Slope's Product Videos

ESPs containing Slope

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Slope named as Leader among 15 other companies, including Affirm, PayPal, and Amount.

Slope's Products & Differentiators

Pay Later for B2B

Slope offers flexible payment plans for businesses

Loading...

Research containing Slope

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Slope in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing Slope

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Slope is included in 4 Expert Collections, including Payments.

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Lending

197 items

Track and capture company information and workflow.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Slope News

Mar 3, 2025

ShipBob Unlocks Access to Funding for its Merchants with ShipBob Capital March 03, 2025, 06:40 AM ShipBob, a global supply chain and fulfillment platform for SMB and Mid-Market ecommerce merchants, announced that its customers in the U.S. can now apply for capital through a new financing program called ShipBob Capital, which is powered by J.P. Morgan-backed Slope and offers a flexible line of credit that merchants can withdraw at any time. Eligible merchants can get approved for up to $250,000 instantly and up to millions of dollars in as soon as two business days, choosing from a variety of best-in-class repayment plans with competitive APRs. The application process takes roughly five minutes to complete and is designed to simplify the financing process with transparent terms and no hidden fees or lengthy contracts. "I'm glad Shipbob is now offering this service," said Mauricio Gomory, CEO of Julian Bakery. "We were approved for ShipBob Capital on the same day and the application process was very smooth and quick. We can keep growing our business without having to worry, knowing that we have access to capital as soon as we need it." "We were thrilled to be able to get approved to the ShipBob Capital program so quickly in January this year," said Claudio Storelli, Executive Chairman of Storelli Group. "There are a lot of options out in the market, but we did not find anything that was as affordable or as quick to get approved. We were able to get approved for a 6-figure line of credit in less than 24 hours, which was incredible. To have ShipBob, our partner on the supply chain side, also help us gain financing for inventory purchases, marketing and more is really a differentiator for us." "Running an ecommerce business comes with unique challenges, from acquiring upfront investments and responding to an ever-changing landscape to managing inventory turnover and meeting growing customer demand. With ShipBob Capital, our merchants can access the funding they need to invest in their business and scale, whether that means stocking up on more inventory or launching new products, without worrying about cash flow constraints," said Dhruv Saxena, ShipBob CEO and co-founder. "We want to help enable our merchants to compete and thrive in the fast-evolving world of ecommerce by providing the resources they need to unlock their full potential in the most convenient way possible." Existing ShipBob customers can learn more by clicking the Finances tab in their ShipBob dashboard and navigating to the ShipBob Capital link. For more information, visit https://www.shipbob.com/partners/slope/ . ShipBob is a global supply chain and fulfillment technology platform designed for SMB and Mid-Market ecommerce merchants.

Slope Frequently Asked Questions (FAQ)

When was Slope founded?

Slope was founded in 2021.

Where is Slope's headquarters?

Slope's headquarters is located at 600 Harrison St, San Francisco.

What is Slope's latest funding round?

Slope's latest funding round is Series C.

How much did Slope raise?

Slope raised a total of $127.13M.

Who are the investors of Slope?

Investors of Slope include Y Combinator, Jack Altman, J.P. Morgan Payments, Monashees+, Union Square Ventures and 13 more.

Who are Slope's competitors?

Competitors of Slope include Tranch, Comfi, Hokodo, Pledg, Aria and 7 more.

What products does Slope offer?

Slope's products include Pay Later for B2B and 2 more.

Who are Slope's customers?

Customers of Slope include Plastiq, Frubana and Go4u.

Loading...

Compare Slope to Competitors

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors, including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Credit Key specializes in providing B2B credit solutions within the financial services sector. The company offers instant business credit at the point of purchase, enabling merchants to increase revenue and improve cash flow by providing their customers with flexible payment options such as net terms and pay over time. Credit Key primarily serves the eCommerce industry, offering a standalone module that integrates with various shopping cart platforms to facilitate real-time credit decisions and financing. It was founded in 2015 and is based in Los Angeles, California.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Vartana is a tech-forward financing platform that focuses on streamlining enterprise B2B payments and sales closing processes. The company offers a CRM-integrated app that facilitates B2B transactions by providing real-time financing quotes, collecting e-signatures, and managing payment flows. Vartana's solutions are designed to increase conversion rates, decrease time to finance, and improve cash positions for businesses. It was founded in 2020 and is based in San Francisco, California.

Loading...